Simple depreciation calculator

Period Period may be in Years Or Months. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

Macrs Depreciation Calculator With Formula Nerd Counter

Straight line depreciation calculator.

. We have created a. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Rental property depreciation calculator.

How Simple Interest Works In This Calculator. This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

Find a Dedicated Financial Advisor Now. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Do Your Investments Align with Your Goals.

The following methods are used. Periodic straight line depreciation Asset cost - Salvage value Useful life. The depreciation is calculated by applying the vehicles depreciation.

The calculator allows you to use. Simple and Compound Calculator Appreciation Depreciation. Hence it is given the name as the diminishing balance method Depreciation Calculator Excel Template.

Use a depreciation factor of two when doing calculations for double dec See more. After a year your cars value decreases to 81 of the initial value. Simple growth 10 of 100.

Business vehicle depreciation calculator. The MACRS Depreciation Calculator uses the following basic formula. Ad Our Resources Can Help You Decide Between Taxable Vs.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Non-ACRS Rules Introduces Basic Concepts of Depreciation. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. Depreciation Calculator Pro has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation. Just enter the loan amount interest rate loan duration and start date into the Excel.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. The calculator also estimates the first year and the total vehicle depreciation.

It calculates the new depreciation based on that lower value. Depreciation Amount Asset Value x Annual Percentage Balance. Our car depreciation calculator uses the following values source.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Calculate your vehicle depreciation Determine how your vehicles value will change over the time you own it using this tool.

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. After two years your cars value.

Sum Of Years Digits Depreciation Concept Formulas Solved Problem Pmp Exam Youtube

Straight Line Depreciation Template Download Free Excel Template

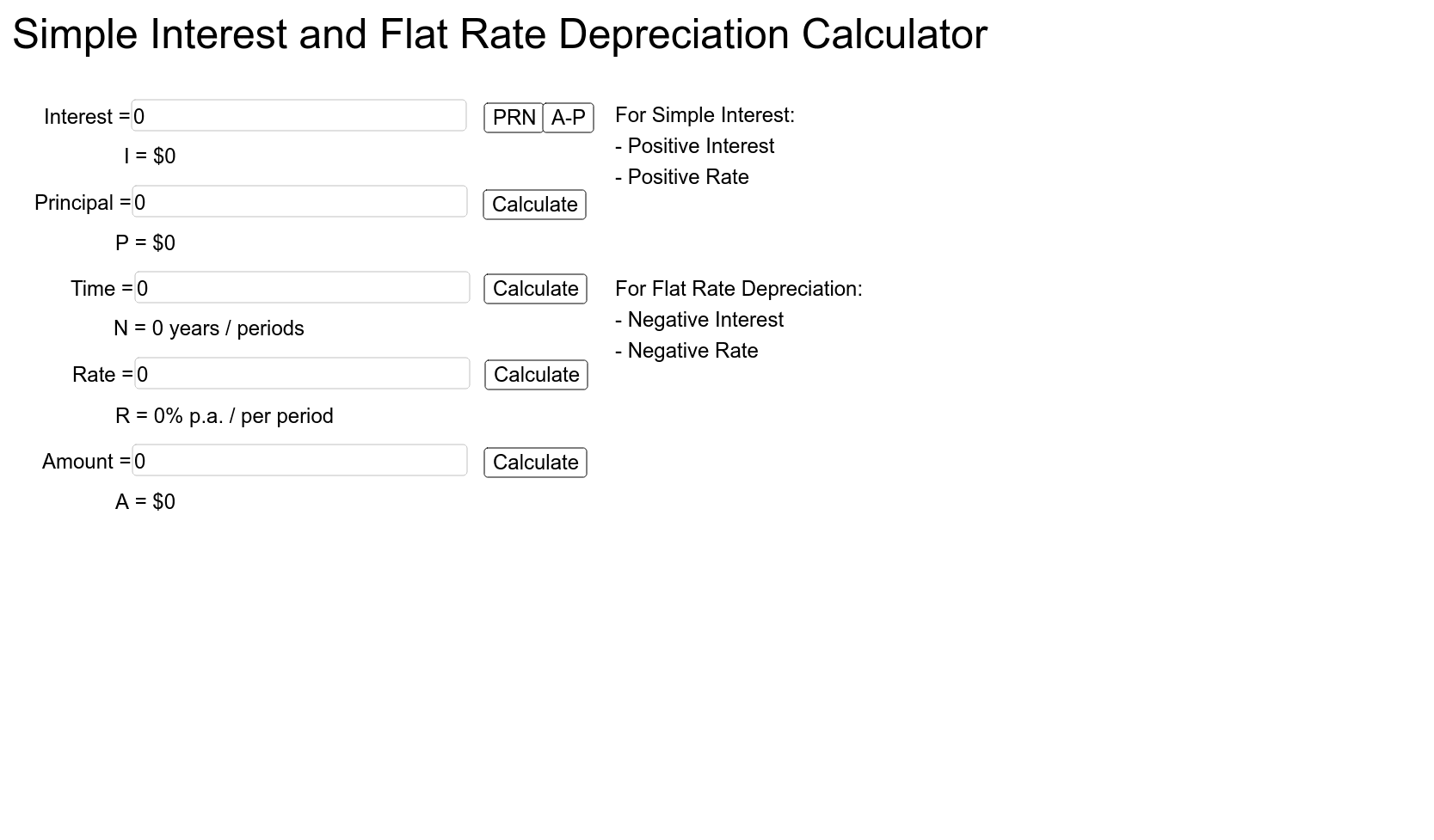

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Free Macrs Depreciation Calculator For Excel

Declining Balance Depreciation Double Entry Bookkeeping

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Tables Double Entry Bookkeeping

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Daily Business

Depreciation Calculator

Straight Line Depreciation Formula And Calculator

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping